Create Generational Wealth With Elevator Rolling Fund

Create Generational Wealth With Elevator Rolling Fund

- Earn Passive Returns (Previous Returns of 300% - 1,200%)

- Ability to Increase or Decrease Capital in Future Quarters

- Passively Multiply Your Net Worth With Industry Experts

- Exclusive Access to Emerging Industries

Elevator Rolling Fund

Invest With Us

In exclusive deals we're already investing in

Flexible Quarterly Investment

Gives you more control over fees

We Do All

The research and vetting

The Opportunity To Fund

Dozens of companies and create thousands of jobs

How It Works

Our Unique Market Edge

Our Unique

Market Edge

Investors get access to a network of credible business owners who’ve successfully scaled and/or exited multiple companies.

We created two masterminds with over a hundred high-level members that generate consistent deal flow.

Our "Elevator Night" events help business owners connect, learn, and form strategic partnerships.

Elevator Studios (parent company) is one of the largest social media agencies in history, helping scale the marketing of companies we invest in.

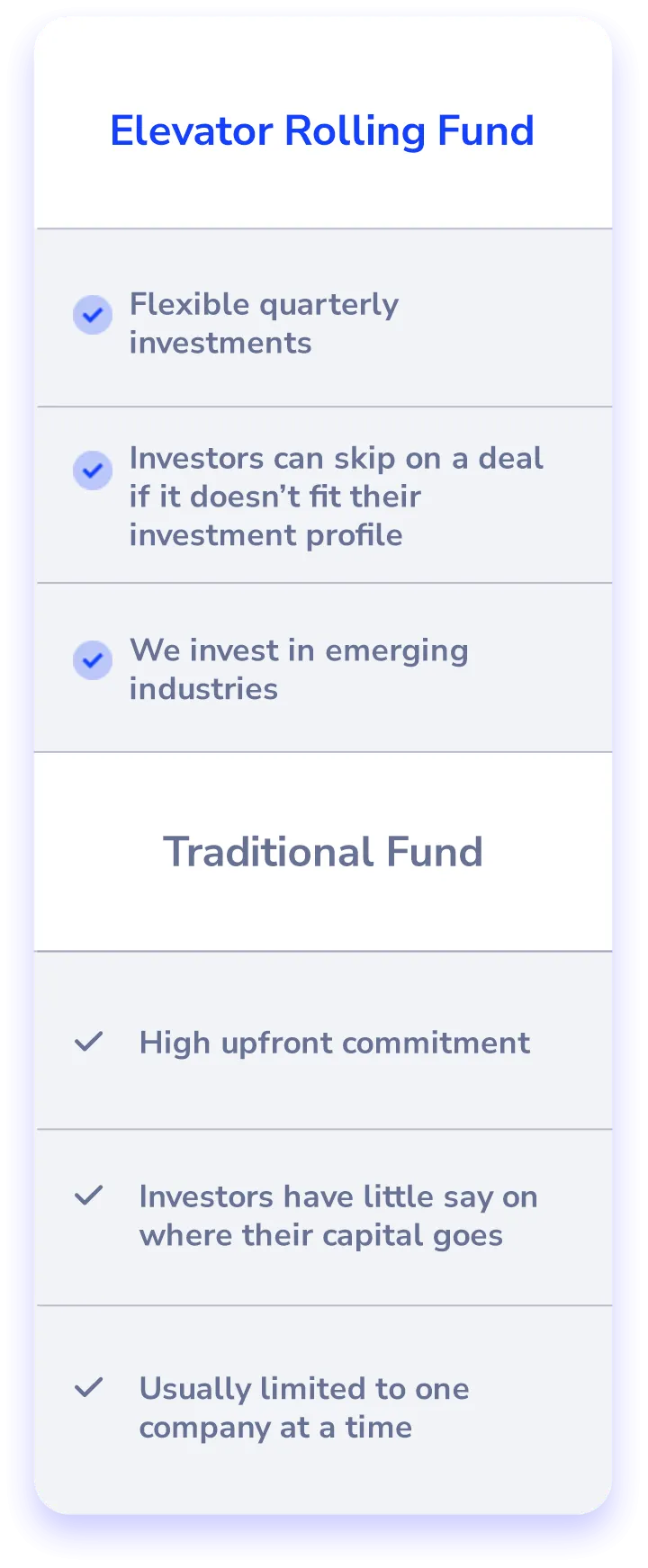

Us vs. Traditional Funds

Meet Dan Fleyshman

- Serial entrepreneur and youngest founder ever to take a company public at the age of 23.

- Founder of "Elevator Studios", one of the largest social media agencies in history.

- Successfully angel invested in 36 companies, spoken at over 250 events, and thrown 47 investment events over the last 7 years.

Meet Joey Carson

- Joey Carson is a 25-year veteran of the entertainment industry and currently serves as president and CEO of Elevator Studio, a leading digital, social media and influencer marketing company that works with leading brands around the world. Carson oversees all day-to-day operations of the company, including client services and new business development.

- Before joining Elevator Studio, Carson worked with several startups and ventures in the digital media and entertainment industries in Southern and Northern California. Previously, Carson was the CEO of television-industry leader Bunim-Murray Productions where he guided the company in the pioneering of the reality television genre that developed and produced hits shows such as "The Real World," "The Simple Life," "Starting Over" and "The Bad Girls Club." Earlier, Carson oversaw Fox's 20th Television production division where he was responsible for a production slate that included the hit shows "Cops," "Divorce Court" and "America's Most Wanted." Carson also held a variety of financial positions with Sony Pictures Entertainment.

- His television credits during the past 25 years include a variety of programming for MTV, HBO, A&E, FOX, ABC and NBC. The Producers' Guild of America and The Hollywood Reporter selected Carson as one of the top 50 producers and innovators shaping the future of digital entertainment.

About Elevator Studios

- Managed over $60,000,000 of influencer budgets for brands, products, mobile apps, and household name companies.

- Handled a wide array of marketing campaigns for Lyft, Postmates, Budweiser, Sony & Draft Kings with diverse talent ranging from the Kardashians & DJ Khaled to Mommy bloggers, fitness icons & micro-influencers in the beauty space.

- Combined reach of over 600M for clients in multiple industries.

- Ability to leverage our global marketing experience to scale Elevator Rolling Fund's investments.

Where We Invest

Travel Industry, Content, Online, Media Sites

Co-Invested in mediakits.com with dozens of strategic investors and Co-Hosted their launch event with Wiz Khalifa.

Health & Beauty Category, Vitamins And Nutrition

We brought along our Elevator Syndicate group members to co-invest $6,000,000 into califlourfoods.com

Apparel, accessories, celebrity goods

Elevator co-founded Talentless.co which has surpassed $10 million in apparel sales.

Subscription, consumer products, fitness

Elevator pre-seed round TheBeardClub.com went onto over 77,000 monthly members equating to 8 figures in sales.

Events, culture, sports, sneaker, mobile app, music, lifestyle, Esports and Entertainment

Sneakercon.com now has 400,000+ attendees internationally and a top-tier sneaker reseller app. eBay acquired Sneaker Con Digital in November 2021.

Food, beverage, retail & franchise

Elevator invested in Açaí Bowl chain Everbowl.com which is now at 55 locations.

Elevator also brought in a Master Franchisee deal for 55+ locations and set up a QVC television show deal while bringing in multiple other strategic investors. Everbowl is now in excess of $20 million in sales annually.

Our Investment Model

The minimum investment per quarter is $10,000, with a 4 quarter minimum commitment.

This minimum dollar amount will likely increase in the future as the fund reaches investor limits compared to our vast network.

The goal is to invest in up to 32 companies annually and also participate in follow-on rounds.

Our Investment Details

Minimum Quarterly Investment:

$10,000

Minimum Subscription Period:

4 Quarters

Management Fee:

2% per annum over each fund's 10-year life, payable quarterly over the first four years

Carry:

Twenty percent (20%)

FAQ

- What makes Elevator Rolling Fund a better option than its competitors?

- Elevator Rolling Fund is your best option when it comes to these kinds of investments and funds. You’ll be hard pressed to find a network as expansive, or as strong, as the network we have at Elevator Rolling Fund. Nor will you find another investment company that is as well-established and has as much exposure as we do due to our Elevator Nights. Elevator Studio is one of the largest social media agencies in history, and the companies in our portfolio, which we’ve helped scale, can attest to our ability. The companies you’ll be investing in are companies which are guaranteed to net you a healthy return, as I, Dan Fleyshman, founder of Elevator, do the vetting process myself. More importantly, these are companies that offer real value to the world, companies which have the same drive and ambition and passion to scale as I do.

- What returns can I expect from investing with Elevator Rolling Fund?

- You can expect carefully selected investments with high passive earning potential. We have had previous successes of 300% to 1,200% for our investors.

- Why is now the time to invest with Elevator Rolling Fund?

- In light of the pandemic and companies being forced to close down, the market is currently experiencing a resurgence and an unprecedented number of newly-opened businesses as people realize the value of start-ups, owning their own businesses, and also trying to capitalize on rebound prices as market activity is beginning to soar. Within all these struggling businesses, countless ones have the potential to be the next Apple or Facebook. And you can be a part of that.

- What if I don’t like the company that’s been chosen for my fund? What if it doesn’t fit my investment profile?

- We all like investing in not only businesses we believe in, but businesses that give us peace of mind, and that’s something that we deeply believe in here at Elevator.

- What is my role as an investor?

- When you invest with us at Elevator, you’ll be a Limited Partner. You’ll be providing all the capital while we do all the work for you and ensure you a passive, healthy return on your investment. As an LP, you gain the benefit of being subject to minimal risk and minimal liability as you do not play any active role in business operations.

What is a Start-Up?

What is a Start-Up?

You may think of a pretty basic answer that most people would probably give:

A start-up is a newly started company with a huge vision and ambition to scale and grow.

But look at it from a different angle:

What does a startup mean to you?

What does a startup represent?

A startup may represent a lot of things.

It may represent dreams, ambitions, goals.

The list goes on and on.

To me, a startup represents hope.

It represents passion.

And there is no passion found in living small.

Passion is your strongest motivator. It is what pushes you through broken dreams, what pushes you through monumental failures, what pushes you when you’re beaten, bloody, broken, and on the ground.

Nobody can explain your passion for something, just as no one can explain what light is to the blind.

At the heart of every startup, there’s a founder. And at the heart of that founder, is drive and ambition. And the thing that founded this drive and ambition, the thing that made the founder become a founder and not just another follower, is passion.

Think of all the failed startups out there, think of all the founders who once had such great dreams and visions for their new business….

…and think of all those shattered dreams and ruined visions.

Think of a small, cozy, family café, an indie business founded by a loving couple who poured their heart and soul into building their establishment from the ground up… for it just to turn into a ramshackle, broken down, boarded up, and abandoned empty space.

Sadly, that’s what most startups end up becoming.

9/10, i.e. 90%, of startups fail.

7.5/10 venture-backed startups close down.

What do you think the top 3 reasons are?

They’re a lack of product-market fit…

…a lack of good marketing….

…and a lack of financial support.

And out of all these failed startups, out of all these broken dreams, came Elevator Rolling Fund and my passion in helping these startup businesses.

My name is Dan Fleyshman, and I’ve seen these failed startups.

I’ve seen founders and owners with defeat and sorrow in their eyes because they were forced to close down the product of their passions and dreams.

And that’s what I set out to fix with Elevator.

Elevator Rolling Funds gives startups, with the most potential, a fighting chance.

We not only offer them access to a huge pool of venture capital from angel investors, but we drastically help with their brand and social media presence, include them in a gigantic network of highly successful business owners and entrepreneurs, a network that helps them with customers, partners, manufacturers, vendors, influencers, and even other investors.

We stay with them from strategy to execution.

I personally take them through the vetting process, because I not only want to give you, the investor, the chance to invest in the companies with the most potential, but I like being personally involved. I like sharing the passion and dream I have to scale up businesses. I only choose businesses whose founders are ambitious, relentless, driven. And most importantly, founders who believe in themselves, their company, and what they’re trying to achieve.

And I know that finding these kinds of companies is a struggle for investors. A struggle that you no longer have to go through because Elevator takes care of all that for you.

You just have to sit down and enjoy the ride, watch a healthy stream of returns to your pocket, knowing that you’re helping people live their dreams out there.

That’s something you can be a part of.

A part of making other people’s dreams come true.

A part of making this world a happier, better place, even if just by a tiny smidge.

And without investors like you, none of that would be possible.